Know Your Customer (eKYC) With Real-Time Communications

Know your customer (KYC) is the process of a business identifying and verifying the identity of its consumers. KYC enables financial institutions (banks) to better understand their customers and their financial dealings.

In today’s competitive marketplace, communication service providers need to make the most of their assets. This is especially true of the customer relationship which, when optimized through analytics and life-cycle management, can deliver increased revenues for service providers.

E-KYC CONTROLS INCLUDE THE FOLLOWING

- Collection and analysis of basic identity information such as Identity documents

- Determination of the customer's risk in terms of propensity to commit money laundering, terrorist finance, or identity theft

- Creation of an expectation of a customer's transactional behavior

- Monitoring of a customer's transactions against expected behavior and recorded profile as well as that of the customer's peers

HOW eKYC Works?

It’s a competitive market. In today’s dynamic and challenging marketplace, customers expect products and services to be far more personalized than ever before.

Know Your Customer or KYC is the regulation that requires financial institutions to verify the identity of their clients. The intent of this law is to make it harder for the bad guys to use financial services. It is a huge burden for the financial institutions and an inconvenience for the customers.

For KYC the customer provides the data and bank collects and verifies them to be potentially shared with the regulators later. A shared database, such as the blockchain, seems like the best tool for the job

The objective of KYC guidelines is to prevent banks from being used, intentionally or unintentionally, by criminal elements for money laundering activities. Related procedures also enable banks to better understand their customers and their financial dealings. This helps them manage their risks prudently

These days, the ability to identify your most profitable consumers, and take steps to retain their loyalty, is imperative. And the case for making sure they remain as customers are reinforced by the fact that the cost of acquiring a new customer can be almost seven times greater than that of retaining one. The best way to identify your customers is to know them.

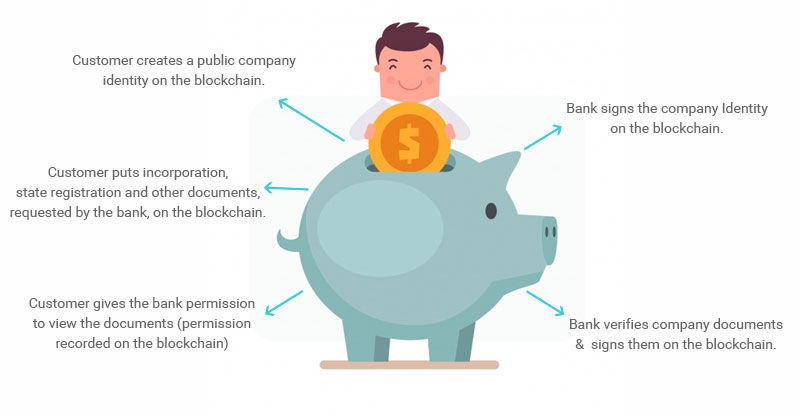

Let's see how this might work. Suppose a startup is opening a bank account. A Bank is gathering the information and

THE POWER OF REAL TIME COMMUNICATIONS FOR eKYC

Real Time Communications is one of the most efficient solutions for eKYC. With live video, banks can interview their customers without the need of travelling, customers can share required documents and entire session can be recorded for the reference. Other than document sharing and verification, real time communications can help financial institutions, insurance companies, advisors, and other entities:

THE TECHNOLOGIES BEHIND LIVE VIDEO FOR eKYC

WebRTC

WebRTC is a platform for enabling Real-Time Communications (RTC) – voice, video, and messaging - within browsers and mobile applications. It enables rich, high-quality RTC applications to be developed for a range of digital environment including browsers, mobile platforms, and IoT devices, and allow them all to communicate via a common set of protocols.

The GC-Collab Platform

GC-Collab Platform is a reliable and secure platform for embedding live video, voice, and chat into websites and mobile applications – with an ease. The scalable, customizable platform empowers the entrepreneurs and brands offer best communications experience, from one-to-one calling to large-scale broadcasts.

WHAT DO YOU NEED FOR AN EFFECTIVE eKYC

Financial Institutions, Advisors, Investment Firms, and other organizations are constantly looking for an efficient solution to ease the entire procedure of eKYC. WebRTC based GC-Collab can help the industry to comply eKYC in a click.

EASY RECORDING

With GC-Collab, one financial institutions or others can verify documents via video collaboration. The entire session can be recorded for future refence.

FILE SHARING

The client or organizations can easily and securely share files, screen and other necessities with each other via GC-Collab.

CLIENT MANAGEMENT

GC-Collab automatically generates a client data base management for your reference. All the shared files, notes, and other stuffs can be stored securely on your dashboard to help you fetch a client details whenever you need

ABOUT GC PLATFORM

GC-Collab is a high-quality real-time communications solution for embedding live video, voice, and messaging into websites and mobile applications.

Integrating the platform into your website or mobile application empowers you for offering better customer service experience, improved team management, and instant collaboration.

Core Features of GC Platform:

- No downloads or plug-ins

- Audio, Video, & Messaging

- One-to-one & One-to-many calling

- File Sharing

- Whiteboard

- Easily Note Making

- Screen Sharing

- Scheduling Meeting

- Video Recording

- Personalized Dashboard